The Transformative Impact of Cryptocurrency on Global Finance

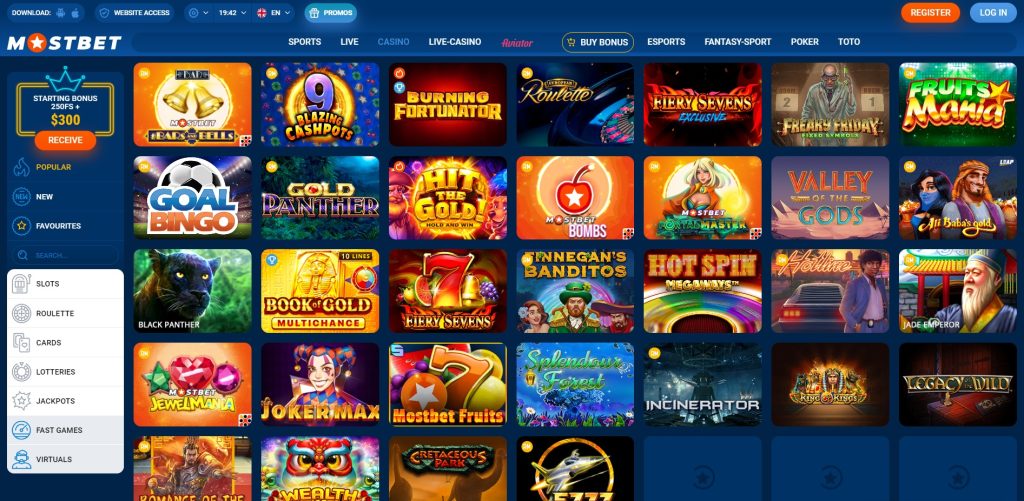

Cryptocurrency has emerged as a revolutionary force in the world of finance, bringing about significant changes in how individuals and businesses conduct transactions. The rise of digital currencies, such as Bitcoin, Ethereum, and countless altcoins, has prompted discussions regarding their potential to disrupt traditional financial systems. This article delves into the multifaceted impact of cryptocurrency on the global financial landscape, examining both its advantages and the challenges it presents. Additionally, we will consider the implications of cryptocurrencies for the future of finance and their integration into various sectors of the economy. As we explore this transformative technology, it’s essential to recognize that the The Impact of Cryptocurrency on Online Casinos in Bangladesh in 2026 Mostbet app is just one of many applications where the principles of cryptocurrency can enhance user experiences and transaction efficiency.

Understanding Cryptocurrency

To comprehend the impact of cryptocurrency, it’s crucial first to define what it is. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. This technological backbone enables transactions to be secure, transparent, and immutable. Unlike traditional currencies issued by governments and central banks, cryptocurrencies are decentralized and typically operate on blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers, ensuring security and transparency.

The Advantages of Cryptocurrency

The rise of cryptocurrencies offers numerous benefits, including:

- Decentralization: Unlike traditional currencies controlled by central authorities, cryptocurrencies are decentralized, giving users greater control over their finances.

- Lower Transaction Fees: Cryptocurrency transactions often incur lower fees compared to those charged by banks and other financial institutions.

- Accessibility: Cryptocurrencies provide an opportunity for financial inclusion for unbanked populations, allowing them to participate in the global economy.

- Fast Transactions: Digital currencies enable swift cross-border transactions without the delays typically associated with banks.

- Security: The cryptographic nature of cryptocurrencies makes them less susceptible to fraud and manipulation.

Challenges Facing Cryptocurrency

Despite its advantages, the cryptocurrency landscape is fraught with challenges that can hinder its widespread adoption:

- Regulation: Governments around the world are still grappling with how to regulate cryptocurrencies effectively, leading to uncertainty in the market.

- Volatility: The value of cryptocurrencies can be highly volatile, making them a risky investment and less reliable as a stable currency.

- Security Concerns: While cryptocurrencies are generally secure, hacks on exchanges and wallet services have led to significant financial losses.

- Lack of Understanding: Many individuals still lack a comprehensive understanding of how cryptocurrencies work, which can deter adoption.

- Environmental Concerns: The energy consumption associated with cryptocurrency mining has raised concerns about its environmental impact.

The Future of Cryptocurrency in Global Finance

As we look forward, the evolution of cryptocurrency is likely to continue shaping the financial landscape. Central Bank Digital Currencies (CBDCs) are emerging as a response to the rise of cryptocurrencies. Many governments are exploring the possibility of issuing their digital currencies, which could coexist with cryptocurrencies and potentially enhance the stability and security of the monetary system.

Impact on Various Sectors

The influence of cryptocurrency extends beyond just finance; it is beginning to infiltrate various sectors, including:

- Real Estate: The real estate market is witnessing the adoption of cryptocurrencies for property transactions, enabling faster and more efficient processes.

- Retail: More businesses are accepting cryptocurrencies as legitimate forms of payment, expanding options for consumers.

- Charity: Cryptocurrencies are being used to facilitate donations, offering transparency and traceability in charitable giving.

- Supply Chain Management: Blockchain technology is being utilized to enhance transparency and traceability in supply chains.

- Gaming: The gaming industry is exploring the incorporation of cryptocurrencies into gaming ecosystems, enhancing user experiences and monetization strategies.

Conclusion

The impact of cryptocurrency on global finance is profound and multifaceted. While challenges persist, the advantages it offers, such as decentralization, lower fees, and accessibility, have made it a compelling alternative to traditional financial systems. As the technology continues to evolve, and as more individuals and businesses embrace cryptocurrencies, we may witness a transformation in how we perceive and engage with money. With the potential for greater financial inclusion and efficiency, the future of cryptocurrency appears promising, positioning it as a vital component of the global economy.